Transmedics reported last night and is one of our largest single stock exposures at ~9%. Core components of the technology were developed in Sydney at St Vincent’s Hospital.

As a reminder, the company offers warm perfusion technology that replicates organs’ natural living environment, increasing survival from the ~4 hours possible under the current technological standard, which was basically a bucket of ice. The company has systems for heart, liver and lungs.

And helpfully, surgeons can monitor vital signs throughout the transportation process to ensure that when the go/no-go decision is made, they have the best possible chance of success. Which is a good thing as failure in transplants is catastrophic.

Financials

The firm posted 159% organic growth and its first GAAP-profitable quarter. This was a 22% increase on their last quarter.

Liver case volume grew 199% year-on-year, heart volumes grew 82%, and Lung grew 11%.

Total operating expenses were up 89%, less than revenues, leading to margin expansion. The company is still a long way from significant profitability, as you would expect from a company growing so rapidly.

Transmedics did 2,300 transplants over the year, and is on track to hit 10,000/year by 2028, though given their consistent outperformance vs their own forecasts, they may achieve this sooner.

This would more than 4x the size of the company from where it stands today.

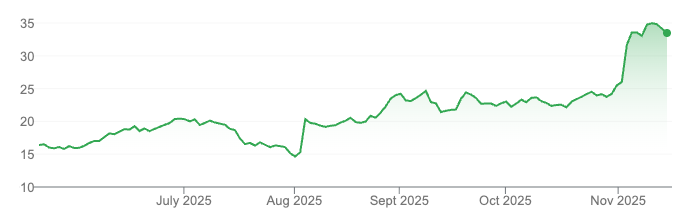

There was some helpful multiple compression going into earnings:

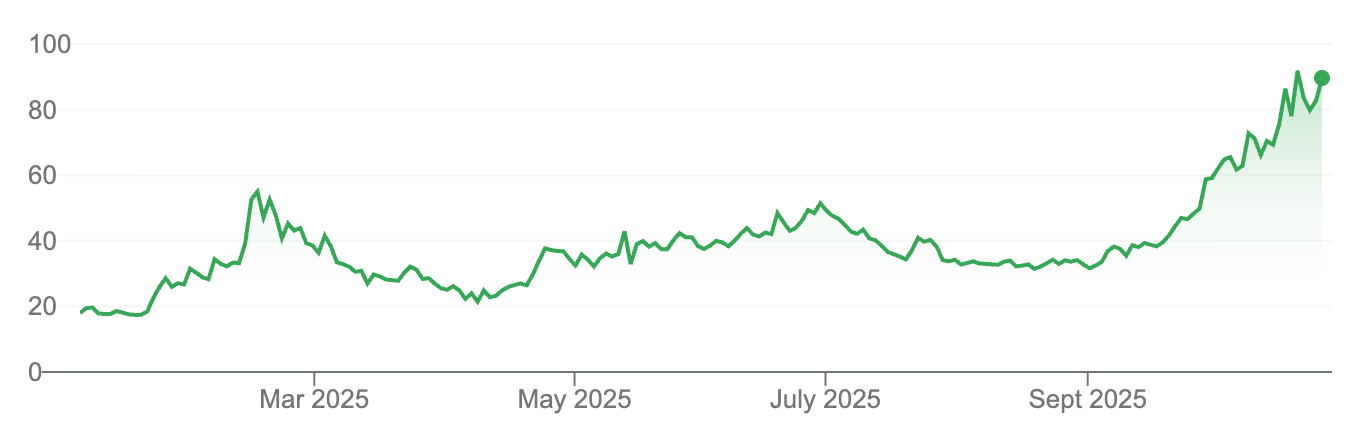

And short of something like NVIDIA in a global frenzy for GPUs, this is about a clean a sheet of upgrades as you will see:

Air transport

The stock had a hiccup last year when they announced their move into aviation. Yesterday the company has answered its critics decisively.

The existing process relies on brokers to charter flights for surgical teams at short notice. This was a huge bottleneck, not least because these flights often need to be made late at night.

Transmedics estimates this resulted in the loss of 20-30% of available organs, and as demand for transplants significantly exceeds supply, every loss represents a patient going without.

Transmedics offered the following arguments for why they’re developing their own network:

- The traditional brokers offered limited range and availability,

- There’s shortage of planes and crews available 24/7. Using brokers to find planes in a fragmented network of small operators adds significant friction,

- Sometimes the only option is to charter multiple flights and stopovers, which can double the cost,

- Lack of control over the starting position of planes leads to further inefficiencies,

- Often the only planes available are old aircraft operating at the limit of their range, apparently leading to near catastrophic incidents for Transmedics crews,

- The network of brokers adds multiple middlemen to the process, each of which requires a profit margin and adds delays and complexity.

Transmedics is building a fleet of modern, fuel-efficient, long-range aircraft, with specialised crew and equipment on every plane on standby 24/7. The network can be managed and optimised nation-wide.

35% of Transmedics missions are already conducted on their growing fleet of 11 aircraft.

This added $9 million of revenue in the quarter that would have otherwise gone to external parties, and while this is lower margin than the Organ Care System, the vision is clear.

Logistics, including their air service, is already operating at a 35% margin, which is already ahead of the 30% margin forecast when this strategy was first announced.

Organs become available in locations all around the United States, but there are comparatively fewer transplant centers. The logistics is non-trivial, and Transmedics makes a convincing case that this is best achieved under fully owned and controlled infrastructure.

Transmedics is the only operator in the United States offering an alternative to cold transportation.

The development of this network further cements their advantage.

Equivalence and Superiority

There was one missing piece for much of Transmedics’s history. They comprehensively proved that their Organ Care System kept organs safely alive for substantially longer with equivalent outcomes to the existing ice-bucket standard. But proving superiority is harder.

This is not such a surprise. How do you do a double-blind trial on organ transplantation? How can you get numbers large enough for statistical significance? How would you control for the different age, health and conditions of each donor organ, not to mention the different times and differences associated with each case?

The company has made moves in this direction and is promising updated data in the near term.

In the meantime, surgeons are voting with their feet. The additional data points on organ health throughout the transportation process are helpful and reduce the guesswork around whether the organ is in sufficient health to survive a transplant.

One of the hopes around Transmedics is that extending the time organs can survive will increase the total number of transplants, and reduce the many people who die on waiting lists (there is a strong argument that these numbers are significantly understated as many in need are not listed on the publicly available waiting lists).

This quarter showed the truth of this, as heart and liver transplants, long steady, grew 12% growth in the United States, attributable to Transmedics’s Organ Care System.

This has investment implications too. Transmedics had ~16% share in heart transplants for example, which gives it room to 4x at the current market size and still be less than 2/3 of the market. But if the market is going to expand, there is space for much further growth.

At a St Vincent’s event last week in Sydney I chatted to some of the surgeons who developed the system in Australia. They made a few intersting points.

One investor thought surgeons should be building their own devices since the science has been understood for some time and building organ care systems was straightforward (maybe for some!)

But it makes sense for one company to specialize in the technology, secure FDA approval, steadily improve it, and roll the system out nation-wide, which we can see in the data.

Most organ transplants are done on brain death, when organs are still functioning. The next opportunity is to expand the use of organs in cardiac death, which is significantly riskier and until recently was thought to be unfeasible, given the damage heart death can cause to organs. Transmedics’s Organ Care System makes these kinds of operations significantly more reliable.

In summary:

- This technology is vastly better and certainly more sophisticated than the current standard,

- The company is on track to 4x from here in the mid-term, and likely more,

- The investment in aircraft which put the stock in a tailspin a few months ago is well-justified and already paying off,

- Transmedics, particularly with their own logistcs system, has defensibility well in excess of patent protection.

In short, it was a strong result.

A panel discussion at St Vincent’s in Sydney with some of the developers of today’s leading heart and lung transplant technology. I asked if they thought brain transplants were possible, and to much general amusement they asked whose brain I had in mind! Answer was technically yes, by the way, but it was not something they would ever pursue.