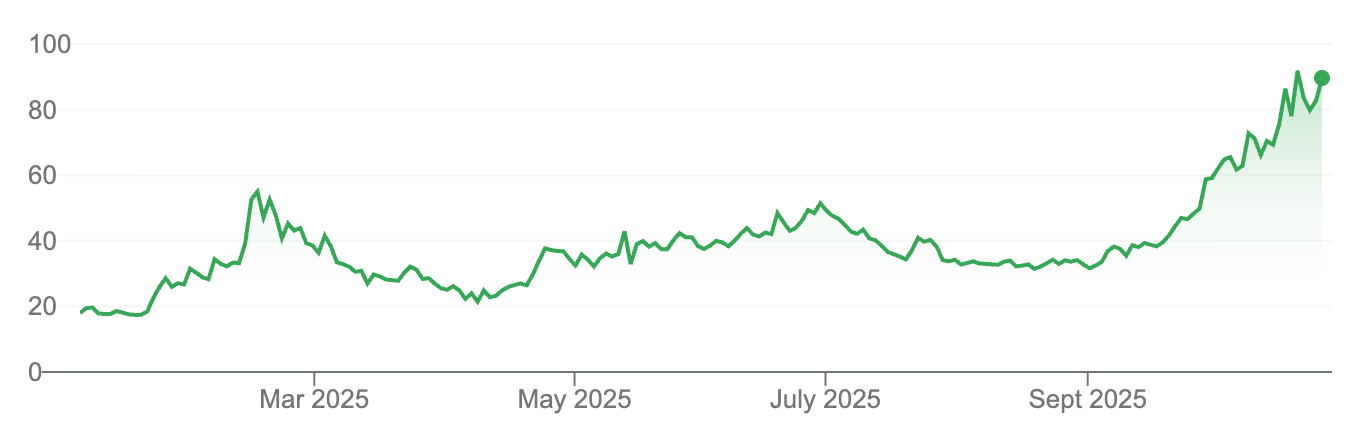

Nubank is our second largest single stock exposure at ~10%, mostly because it’s moved up quite a bit recently.

I wrote recent notes on other major positions like Clarity Pharmaceuticals and Transmedics.

Results

The company’s latest report was impressive:

- 19 million new customers over the year, including 4.8 million in the last three months alone. Total is now 93.9 million.

- Revenue per customer grew 23%, with total revenues up 57%,

- The cost to serve each customer stayed roughly flat, leading to decent operating leverage,

- Gross profits grew at 87% on a fixed currency basis,

- Net income grew at 229%,

- Return-on-equity came in at 23%, which is ahead of say, Australian banks (CBA is at ~14%). In Brazil, ROE was over 40%, but the total was brought down by significant investment in the new markets of Mexico and Columbia,

- Net interest margin was 18%, up from 13% a year ago (banks in Australia are around 2%). Risk adjusted net interest margin increased to 10%, from 5% a year ago. Nubank is heavily skewed towards personal loans and credit cards which have much higher margins (and losses) than say, Australian mortgages.

Growth opportunity

There are four parts to the investment opportunity:

- Growth in new customers

- Growth in revenue per customer

- Operating leverage on that customer base, both through managing cost-to-serve and improving credit quality

- Valuation

New customers

Customer growth has predominantly come from Brazil, where 53% of the population has Nubank accounts, making it the fourth largest financial institution.

While there is room to grow customers here, the opportunity lies in expansion throughout South America, with successful recent launches in Mexico (population 127 million) and Columbia (population 52 million), which offer a similar opportunity to Brazil (population 214 million).

The launch in Mexico was initially challenging as the landscape is different to Brazil eight years ago (where customers where apparently often searched at entry by rifled security), with plenty of well-funded fintechs offering attractive alternatives to incumbents. The company believes revenue per user in Mexico will exceed what they achieved in Brazil.

The company added a million Mexican customers to reach a total of 5 million in the quarter, driven by exceptionally high deposit rates (15%). This has allowed them to fully finance lending in the country, removing financing risk. This is still profitable. American Express credit cards charge 42% in Mexico, for example.

As elsewhere, many incumbent banks pay little to no interest, and are in a classic dilemma: the status quo is too profitable to change, even at the price of allowing an aggressive new incumbent to gain a foothold.

Credit card penetration is 12% in Mexico (vs ~60% in places like Australia and the United States).

Nubank has only recently entered its third market, Columbia, securing its first 800,000 customers. Across the continent, Nubank has 5% market share.

Growth in revenue per user

Older cohorts are spending 2.5x what the average customer is. This gives a 2.8x growth opportunity from existing customers alone, which multiple held constant, would put the share price at >$26 (from today).

Cost to acquire a customer is about $7.

Growth in profitability

The company estimates their cost to serve customers is 85% lower than the Brazilian majors.

Nubank specializes in credit cards and unsecured loans. This is the typical starting point for all kinds of startups around the world, as it’s easy to do this digitally. Secured loans require additional expertise. Far easier to accept higher losses and charge far higher rates.

Credit cards and personal loans are surprisingly good products, but many startups (as true in Australia as elsewhere) fail because they end up with the worst customers - those who can’t borrow anywhere else. It’s easy to grow by giving money out.

Nubank is past this death zone, and has survived one cycle of credit losses with flying colours and a substantially larger, more mature customer base. And every day they accumulate more data on which of Nubank’s 95 million customers make the best borrowers. The company is below industry averages on ticket size and loan duration.

Nubank’s has significant deposit financing, which brings their total cost-of-funding 20% below interbank rates. Of their $43 billion of assets, $24 billion are financed with deposits. This is actually lower than most Australian banks. Deposits are the best source of funding, not least because so many are in low interest accounts. The company maintains capital at ~2x regulatory requirements. $6.4 billion of their book is equity financed (~15%).

(For what it’s worth there’s an Australian ETF called AAA that has daily liquidity and currently pays 4.45% per annum. I’ve found it significantly more convenient than managing term deposits).

Finally on operating leverage, ~60% of Nubank’s operating costs are in headcount, and according to the company, 40% of that is allocated to businesses that are in growth or ‘moonshot’ projects, so are contributing little revenue. This gives further room for margin expansion in the future… but not yet. Growth in Brazil is now self-funding.

Valuation

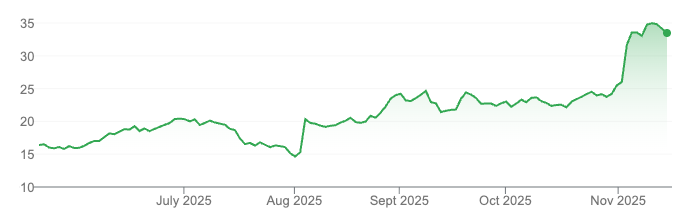

Finally valuation. It’s undemanding at 27x PE, and 16x next year (at current rates they will beat estimates and this will turn out lower).

Earnings have increased faster than the company’s share price, resulting in a rapidly contracting earnings multiple.

Risks

The risks are clear, losses could expand more than expected. The key mitigant is maturity of loan book, though we are applying a risk model to our holdings. Regulations could change to favour incumbents, rather than new entrants, though this would be picked up by our risk models. For now, every model is flashing green, as well as our own analysis of the prospects of the business and each of its quarterly results which have reinforced our conviction in the thesis.

I’m clearly optimistic on the business and this note reflects that view, and includes comments from management who as you can imagine, project an even more optimistic outlook than we do.

But it must be acknowledged credit cards and personal lending in South America is at the pointy end of credit risk, and compared to countries like Australia, very high rates must be charged to customers to make up for this.

The risks must be balanced against returns.

We think customers can double over the next five years as Nubank continues to grow in its core market of Brazil, as well as in new markets of Mexico, Columbia, and elsewhere in the continent.

Revenue per customer can plausibly triple from here, matching early cohorts which are still growing. And operating leverage will continue in the business as customer quality improves, costs remain comparatively as management has consistently demonstrated, and Nubank continues to take market share in deposits.

Assuming the forward multiple of 16x remains constant, this would give a >5x upside return opportunity and price Nubank’s stock at well over $50, which, sized at ~10%, would add 50% to the value of the fund.