Dear investors and well-wishers,

The fund contracted -10% return for the month of October. We are up ~17% in November so far.

Companies like TransMedics and MercadoLibre sold off heavily, but have since posted strong Q3 results.

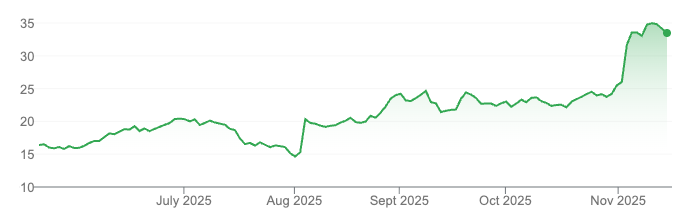

TransMedics sold off since July, but partially recovered after posting results a few weeks ago.

TransMedics fell from a high of $100 in July to $36 only a few weeks ago. This was partly due to a sell-off across healthcare, GLP-1-related or not, and partly due to their decision to acquire a small fleet of planes - which is perhaps one of the last things you want to see a portfolio company announce.

The market reaction was fierce, but there was logic to the decision. Organ transplants often require transportation by air, which can be a significant part of the overall cost. These acquisitions allow TransMedics to control the entire transportation process. They can ensure there is always capacity when required, optimize the network for transplants, and charge insurers accordingly.

Air transportation adds an incremental US$30k - US$100k revenue per transplant, depending on the distance travelled (albeit with a lower gross margin of 25%, compared to the core business at 80%).

TransMedics is founder-run and creating a US-wide market for organ donation is the kind of bold, long-term move that committees find difficult to make.

As the market digested these new economics, the company posted 159% year-on-year revenue growth and boosted full-year guidance by 20%. Stripping out costs associated with this acquisition, Transmedics was profitable for the quarter, sparking a strong rally to our first entry point (we added a little at ~$40).

MercadoLibre

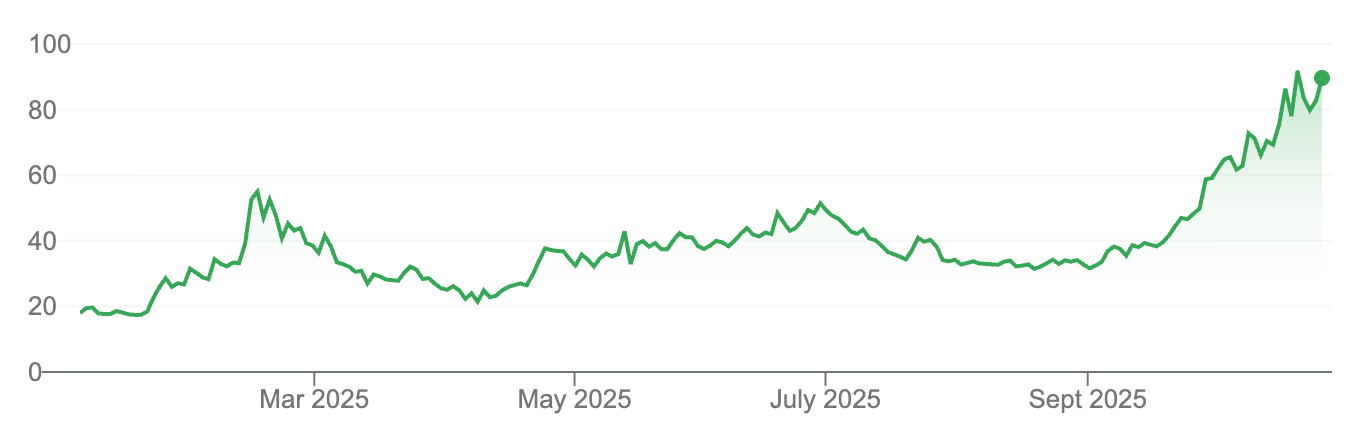

MercadoLibre outperformed expectations again in Q3, with 69% year-on-year growth in net revenue to $3.8 billion, and a significant operating profit of $685 million. Operating margins have expanded from 11% a year ago to 18%.

Source: MercadoLibre Q3 Investor Presentation

MercadoLibre now controls 44% of the Brazilian e-commerce market.

Brazil e-commerce market share by company (1Q20 - 3Q23)

MercadoLibre is our largest position, followed by TransMedics.

NuBank delivered an earnings beat of 20%. GAAP net income in Q3 was $303 million, a significant jump from $7.8 million the previous year. Additionally, revenue growth remained strong at +53% year-over-year, reaching $2.1 billion.

Last quarter, NuBank added 1.5 million new customers each month. With over 89 million customers in total, Nubank now serves over half of Brazil's adult population making it the fourth largest financial institution by customer base - not bad for a company founded 10 years ago.

Growth in the coming quarters will be driven by emerging markets Colombia and Mexico as new products that have been highly successful in Brazil are gradually launched in these markets.

Outlook

Some companies we own in Australia, like Camplify, have delivered good fundamentals but are trading roughly where they were at the beginning of the year. The company is now break-even, growing at over 60% organically, and trades at around 3x EV/gross profit, with $25 million in cash on the balance sheet.

Camplify has delivered results but straight-lined all year. While it's helpful it didn't collapse like many other Aussie small caps, it has lagged offshore tech stocks that are trading multiples higher with significantly lower growth

As expected, CRISPR achieved the first approval for their sickle cell treatment, and it looks increasingly like the life sciences has put in a low, which may be generational.

This new treatment is a multi-stage ‘ex-vivo’ therapy, involving rounds of chemotherapy, bone marrow extraction, editing and reinsertion. The next generation of gene therapies will eliminate some of these steps, and are where we expect the most revenues long-term. These are not small molecules that can easily be replicated either. After a few good weeks, they are all still trading right at the lows.

XBI is off the lows with some big recent announcements

It’s helpful to see inflation finally rolling over, though the biggest move will happen when rental data with its six month lag is represented properly. As companies like TransMedics, Nubank, and MercadoLibre show, there are fantastic growth opportunities that are still well below their peaks nearly three years ago.

Best regards

Michael