Dear investors and well-wishers,

The fund returned 1% in March.

We seem to be at one of those junctures in markets after a strong rally since last November.

Microsoft

Last week we spoke to a Chief Architect at Microsoft who shared some telling anecdotes. In 2019, Microsoft planned to open 100 datacenters over the next decade. They are now building more than 100 every year, and are increasing their number of datacenters from 192 today, to 800 by 2028. This is a fourfold increase in capacity and will have to be matched by the other hyperscalers if they want to retain market share.

This is driven by customer demand: Microsoft is opening a new datacenter every three days, and when they switch them on they are operating at full capacity within 3-5 hours.The capex buildout in AI is likely to be one of the largest in history, perhaps the largest.This is getting people excited (and nervous) about the energy requirement. Apparently Microsoft is exploring developing their own nuclear reactors.

Data centers are forecast to grow from 4% of US energy demand to over 10% by 2030. After years of stasis US electricity demand is forecast to surge 4-5% a year into the mid-term.

This all supports our existing thesis around a stepchange increase in demand as more models are released, and context windows are extended out (compute increases by the square of context length).We discussed custom chips and the prevailing consensus is that these are still some way away from denting demand from state-of-the-art general purpose NVIDIA products, though Microsoft is directing customers to their own custom silicon wherever they can. It took Microsoft multiple years and immense investment to develop their custom silicon, and it's unlikely many companies will be able to do the same.

But the market certainly looked overextended in the sector. Fund managers and algos flipped from close to max short only last November to max long.

ASML and Taiwan Semiconductor reported

ASML and Taiwan semiconductor reported their quarterly earnings last week. ASML's orderbook missed expectations, but the firm reiterated their guidance for the full year, so they are clearly anticipating large orders likely under negotiation now.This comes after their record quarter earlier in the year when orders came in way ahead of expectations, so there's likely an aspect of order timing here.

Taiwan was noticeably light, so perhaps there are negotiations with TSM which are giving ASML the confidence to give such strong guidance for the second half of the year.Still, it was notable as a first crack in the thesis and one to watch closely.

The most concerning part was that China remains 49% of revenues, even after extensive export controls (top left in the table below). This was partly due to Taiwan being a minor contributor, though we know that Taiwan Semiconductor is the largest single purchaser of ASML's most advanced equipment.

Unlike Taiwan Semiconductor or even Nvidia at 35x, ASML is expensive, trading at 42x this year's EPS. Taiwan Semiconductor beat on revenue and earnings, but still sold off, which is another clue as to how the market is positioned. Revenues were guided to raise 20% this year, led by datacenters, with the second largest segment, smartphones shrinking.

So it's a good illustration of the challenges in the semiconductor sector - immense demand for datacenters and AI-related compute (TSM expects to grow at 50% over the next few years), and smartphones, personal computing, and now autos, which are in a slump. The decline in smartphones has been extended and is clearly more than a standard cyclical downturn. It remains to be seen if AI-enabled generation of smartphones is enough to convince consumers to upgrade.

Source: Taiwan Semiconductor's Q124 update

Semiconductor sell-off

On Friday there was a 10% fall in NVIDIA and a 23% fall in SMCI, one of the top global performers.Multiple datapoints showing that the multi-year demand story is intact, and if anything, accelerating, especially with the release of GPT-5, Llama-3, and other advanced models.

But semiconductors are likely the most crowded trade right now.We're going to apply our risk models religiously across the sector, which means we remain fully exposed, but would cut risk if things fall much further.

We closed AMD for reasons discussed in a prior note, namely that it was trading more expensively than the market leader Nvidia, while being more exposed to personal computing.

More GLP-1 news

Eli Lilly reported their lead GLP-1 drug tirzepatide/Mounjaro led to a 63% reduction in sleep apnoea in obese patients in a widely awaited trial.We now have evidence that GLP-1s improve:

- heart health

- liver health-

kidney health

- sleep apnoea

- and early evidence they help neurological diseases like Parkinsons.

There has long been a hypothesis that many diseases are metabolic in origin, and the growing mountain of GLP-1 evidence across a wide range of conditions supports this.Lower blood sugar spikes, lower calorie intake, lower weight and less fat around major organs are clearly correlated with better health. This is what you would expect, but it's still impressive to see it play out in large-scale, rigorous, and highly scrutinised trials.

Early concerns around negative health impacts of GLP-1s have generally not been seen in the largest trials, though nausea, stomach pain, and anhedonia are part of the price to pay for all these benefits. And throughout the year we will have more data on the next generation of more powerful drugs in tablet form.

Earnings season begins again

We are in a buy-back blackout window for most stocks, which tends to exacerbate moves. We will be watching closely for comments on the capex programs of Google, Microsoft, Amazon and Meta.

Profits in the 'Mag 7' are forecast to surge 38% this quarter, vs negative growth in the rest of the market. Another tricky position with positive fundamentals weighed against headwinds from market positioning. Apple has clearly missed a beat on AI, with Siri looking ancient relative to state-of-the-art voice models.

Apple announced a partnership with Gemini, but this model has already fallen behind GPT-4, Llama 3, and Claude, with GPT-5 still to come.Apple's Worldwide Developer Conference is in mid-June, where it's assumed Apple will announce AI capabilities across its product range. There may be hints and clues in their earnings call in early May.

True customer love and explosive growth

Our old focus on true customer love and explosive growth has proven an effective lens for investing in AI.

The company everyone loves most, Nvidia, has also posted the highest dollar growth and created the most dollar value. It's also led us to profitable investments in companies like Nubank, Transmedics, and Celsius. And lower tier large language model developers which couldn't attract customers have already begun to throw in the towel.

Good things don't last forever, and with $200 billion of chips subsidies across the EU, the US, China and Japan, there certainly will be an oversupply at some point, but we just don't seem to be there.

The first clue might be in second hand values, which collapsed in the last chip sell-off when Nvidia cards were dumped by crypto miners on eBay.Tesla's second hand values gave an early clue to changing supply/demand and earnings estimates (and the stock price) has collapsed since.

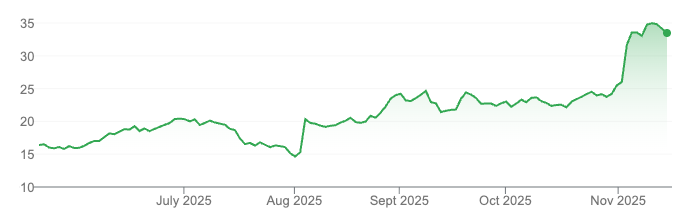

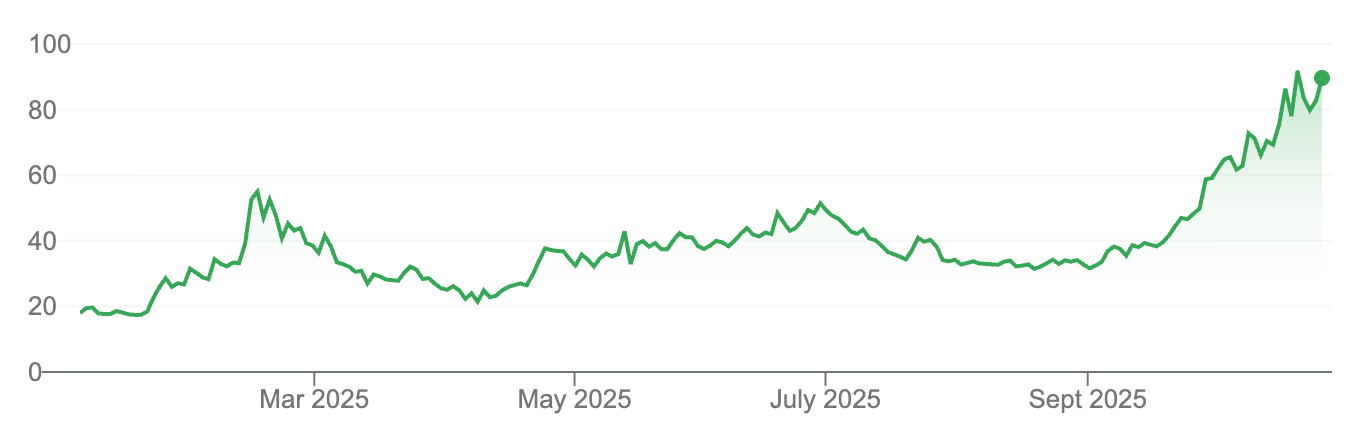

Tesla stock price and revenue estimatesAt some point this will happen in semiconductors too. Microsoft is reportedly developing a $100 billion 'Stargate' supercomputer with OpenAI, which is triple their entire 2023 capex line. So we don't quite seem to be there yet.

Michael

Disclaimer

The information in this note has been prepared and issued by Frazis Capital Partners Pty Ltd ABN 16 625 521 986 as a corporate authorised representative (CAR No. 1263393) of Frazis Capital Management Pty Ltd ABN 91 638 965 910 AFSL 521445. The Frazis Fund is open to wholesale investors only, as defined in the Corporations Act 2001 (Cth). The Company is not authorised to provide financial product advice to retail clients and information provided does not constitute financial product advice to retail clients.

The information provided is for general information purposes only, and does not take into account the personal circumstances or needs of investors. The Company and its directors or employees or associates will use their endeavours to ensure that the information is accurate as at the time of its publication. Notwithstanding this, the Company excludes any representation or warranty as to the accuracy, reliability, or completeness of the information contained on the company website and published documents.

The past results of the Company’s investment strategy do not necessarily guarantee the future performance or profitability of any investment strategies devised or suggested by the Company.

The Company, and its directors or employees or associates, do not guarantee the performance of any financial product or investment decision made in reliance of any material in this document. The Company does not accept any loss or liability which may be suffered by a reader of this document.